“ .. for giving prudence to those who are simple, knowledge and discretion to the young - let the wise listen and add to their learning, and let the discerning get guidance.”

Proverbs 1:4-5

Whether in our families, across the nation or between nations, inter-generational rebalancing is a vital part of the cycle of life. As Benjamin Franklin said, ‘nothing is certain except death and taxes’: and worldly wealth counts for nothing in the afterlife, as the parable of Dives and Lazarus explains so graphically.

The problem is that we're not doing well at inter-generational rebalancing: not within families, with young adults finding it impossible to extricate themselves from student debt and get onto the home-ownership ladder, not across the nation, where the polarisation of wealth remains acute, and not internationally, as we heard in last week’s debate on the British contribution to overseas aid.

So in this commentary we look at these three levels where a better process of cascading wealth, and the ability to handle it, down the generations is so badly needed.

It was David Willetts who first drew public attention to the increasing problems of inter-generational wealth transfer in his book ‘The Pinch’. He wrote of the increasingly stretched nature of inter-generational links: as the gap between generations gets larger, old people live longer, and more families break apart through divorce and separation. Undoubtedly the pandemic has made this worse.

Responsible ‘mass affluent’ wider families will have plans beyond simply waiting for inheritance – which, in any case, is often severely impacted by care costs and inheritance tax. There are all kinds of judgments to be made, including how to make inter-generational assistance empowering, without undermining a young person’s natural drive for achievement.

There are many structures available for this: trusts, ‘Bank of Mum and Dad’, Junior ISAs, Lifetime ISAs. Each wider family should have at least one person who can be a key source of knowledge and education, in order to ensure that the teenagers and young adults are making the best use of the opportunities that can be afforded; and, increasingly, financial service firms are introducing family finance guidance to help with this.

So far as addressing the polarisation of wealth across the nation, young adults are doubly impacted due to the higher birth rate among the economically-disadvantaged, and the extent of immigration, particularly focused on young people.

I don’t agree with the IPPR’s concept of providing a slab of capital for each young person at 25 years of age. The challenge is not simply wealth distribution, but to nurture the ability to handle that wealth.

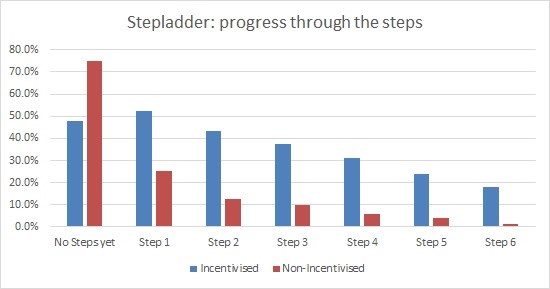

The Share Foundation has tackled this by introducing its Stepladder of Achievement incentivised learning programme alongside the asset accounts (Junior ISAs, Child Trust Funds) which it runs for young people in care on behalf of the Department for Education. Progress through this life skills learning programme is transformed by the ‘earning’ experience, as is shown in this chart.

The Share Foundation has tackled this by introducing its Stepladder of Achievement incentivised learning programme alongside the asset accounts (Junior ISAs, Child Trust Funds) which it runs for young people in care on behalf of the Department for Education. Progress through this life skills learning programme is transformed by the ‘earning’ experience, as is shown in this chart.

The major Child Trust Fund recovery programme which The Share Foundation has now established for 16-18 year-olds is based on a resolve to establish the combination of an asset account for young adults alongside life skills learning. At present, the campaign is focused on linking young people to their accounts: it is hoped to introduce an incentivised learning programme to provide additional empowerment in due course. The long-term objective is to show Government how effective this type of programme can be, so that it is re-introduced on a permanent basis for future generations.

Finally, there’s the international dimension. It's clearly been on the minds of G7 leaders as they met in Cornwall, but the scale of the challenge is immense. It's so easy to fall back into socialism and state control but, as we wrote on 4th May, imposing intermediation is not the answer. This must be found through individual empowerment.

Individual charities such as Five Talents understand this so well, but in terms of scale they are scratching the surface: for example, 263,000 people have participated in a Five Talents programme since 2005 - an impressive number, but the challenge is to extend this to the billions of young people who are in need of programmes like theirs.

This is why King’s College Cambridge and the University’s Economics Department are establishing the research fellowship which will put academic rigour into plans for egalitarian capitalism. Increasing the scale of inter-generational initiatives will require the full co-operation of western developed nations, and they will need persuading by rational arguments and convincing outcomes assessments.

Alongside climate change, effective inter-generational rebalancing is the key imperative of our time.

Gavin Oldham OBE

Share Radio