“The test of our progress is not whether we add more to the abundance of those who have much; it is whether we provide enough for those who have too little.”

Franklin D. Roosevelt, in his second inaugural address (1937)

The news on Friday that 260 year-old London wealth manager Brewin Dolphin had agreed a £1.6 billion takeover by Royal Bank of Canada is a further sign of massive change underway in the securities markets. It follows Raymond James’s £279 million purchase of Charles Stanley and the acquisition of Nutmeg by JP Morgan Chase for just £70 million. The significance of these transatlantic deals is that, while globalisation may be going through a bumpy period, it is definitely not a thing of the past.

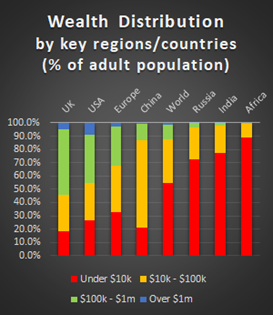

Which is just as well, because the contrast in wealth distribution between key regions and countries around the world is as stark as ever, as our chart shows (source: Credit Suisse Global Wealth Databook). The red elements represent the percentage of adult populations with less than $10,000 to call their own: in the UK that’s 18%, in India it’s 77%, and in Russia it’s 73%.

It’s why this commentary calls so often for a more egalitarian form of capitalism: the UK and US have a long way to go, but the much larger percentage of those in the $100k-$1 million band shows that at least there’s wealth creation under way. If you’re not generating wealth, you can’t share it.

So in this commentary we look at some of the factors which are moving these realignments, and at the convergence we need to achieve in order to help encourage a more egalitarian form of global capitalism.

Our 14th March commentary spoke of trade imbalances in a MAD world, and newspaper headlines tell us every day about the challenges they have created - particularly in energy. The abundance that both Europe and America have enjoyed as a result of feasting on cheap oil and gas from Russia and cheap labour from China is drawing swiftly to a close, and the fear is that it will be replaced by a scarcity which will threaten us all: witness the plans to ration gas in Germany, and its implications for German economic output.

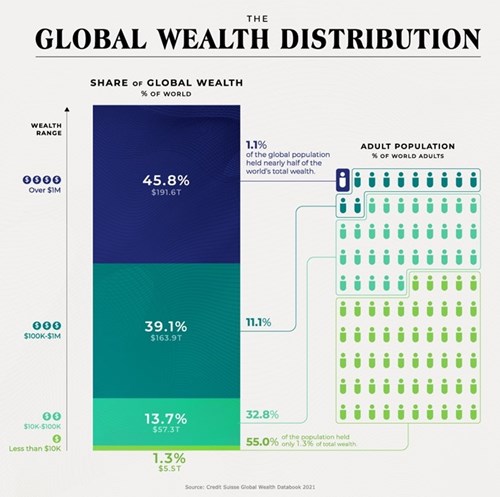

This week’s episode of The Hypnotist speaks of abundance and scarcity and makes the valid point that it's as much a psychological phenomenon as a physical one. It could be argued that there's more than enough to go round — it's a question of how it shared, and how to address the anxieties it creates. But the problem is that it is not shared: there’s still an immense polarisation of wealth, made worse by soaring asset prices as a result of rock bottom interest rates and the wealth concentration of the tech giants. Here’s a chart from Visual Capitalist based on the same Credit Suisse analysis:

The SHARE project at Cambridge is designed to address this challenge, and global convergence and disintermediation will be key features in finding the solutions.

The way forward will not be unlike the gradual transition towards addressing climate change: it takes several years to change the mindset so that political leaders and regulators understand the logic for change. That's why the move towards egalitarian capitalism starts with building academic rigour into these plans.

The logic will also have to work its way into authoritarian nations, including China and Russia.

At least in China, as the chart shows in the amber section of their column, there's an understanding of the process of wealth creation, and the communist presumption in favour of a more egalitarian society appears to be spreading that wealth, even though it is so heavily intermediated.

At least in China, as the chart shows in the amber section of their column, there's an understanding of the process of wealth creation, and the communist presumption in favour of a more egalitarian society appears to be spreading that wealth, even though it is so heavily intermediated.

However, Russia suffers grinding levels of poverty not much better than India, having been endowed with the worst traits of both communism and capitalism. It has maintained its authoritarian dictatorship while allowing a raft of oligarchs to steal so much of the country's wealth. It will therefore be a difficult journey to move towards an egalitarian, disintermediated society: but, paradoxically, the impact of Putin's unsuccessful war in Ukraine will do much in due course to move the Russian people towards evaluating their potential as a free society, where opportunity is open for everyone.

Technology and social media will play a key role in making that transition, since communication must flow easily to enable people to imagine a different future. When the Ukraine war is over and sanctions can be lifted, the West must be much more inclusive for people in Russia and China, and encourage dialogue, travel and investment to flow.

If we want an example to follow, there’s no better than the contrast for Germany after each of the two world wars. After the first, the call for reparations and punishment (made worse by the premature illness and death of President Woodrow Wilson) resulted in the rise of national socialism; while after the second, the Marshall Plan brought West Germany into a community of nations which shared a respect for one another.

There is also a great deal that needs to be done in the fields of regulation and administration, as we have called for in the past. Finance and investment remain very nationally centric, and we need leadership from the G7 finance ministers to encourage much improved convergence.

Mergers and acquisitions in the field of finance and investments often reflect strategic positions taken by leaders who understand how opportunities will open up in the future, and those to which we refer at the beginning of this commentary point towards such increased integration and convergence in the years ahead. They may not, in all cases, be ready to embrace a more egalitarian and disintermediated approach, but they will be quick to take up opportunities as they arise.

So, as with climate change, the SHARE project will start building that academic rigour, then move on to world influencers such as the G7 finance ministers, and in due course start tackling the huge disparities of wealth, that abundance and scarcity so graphically displayed in the Credit Suisse databook.

This is a time when we need to think optimistically about the future, set a path for economic change, and help businesses with imagination and ambition make it happen.

Gavin Oldham OBE

Share Radio